Little Known Questions About Transaction Advisory Services.

Wiki Article

The Facts About Transaction Advisory Services Revealed

Table of ContentsGetting The Transaction Advisory Services To WorkThe Ultimate Guide To Transaction Advisory ServicesEverything about Transaction Advisory ServicesThe Greatest Guide To Transaction Advisory ServicesThe Definitive Guide for Transaction Advisory Services

This action ensures business looks its ideal to potential purchasers. Obtaining business's worth right is essential for an effective sale. Advisors make use of different methods, like reduced capital (DCF) analysis, contrasting with comparable companies, and recent deals, to figure out the fair market price. This assists establish a fair price and discuss effectively with future purchasers.Transaction advisors action in to help by obtaining all the required info arranged, addressing concerns from buyers, and arranging visits to the organization's place. Transaction experts utilize their knowledge to help business proprietors handle tough negotiations, fulfill purchaser expectations, and framework deals that match the proprietor's goals.

Fulfilling legal regulations is critical in any type of business sale. Deal consultatory solutions deal with lawful experts to develop and evaluate agreements, agreements, and other lawful papers. This minimizes risks and makes certain the sale follows the regulation. The role of purchase advisors prolongs past the sale. They help local business owner in planning for their next steps, whether it's retirement, starting a brand-new venture, or managing their newly found riches.

Deal consultants bring a wide range of experience and expertise, guaranteeing that every element of the sale is handled skillfully. Via strategic prep work, valuation, and settlement, TAS assists company owner attain the greatest possible sale rate. By ensuring legal and regulative conformity and managing due diligence together with other deal employee, transaction advisors minimize possible threats and liabilities.

Getting My Transaction Advisory Services To Work

By comparison, Huge 4 TS teams: Work on (e.g., when a prospective customer is carrying out due diligence, or when an offer is closing and the purchaser requires to incorporate the business and re-value the seller's Balance Sheet). Are with costs that are not linked to the offer closing efficiently. Gain costs per engagement somewhere in the, which is less than what financial investment financial institutions gain even on "small offers" (however the collection chance is also much higher).

, yet they'll focus extra on accountancy and valuation and much less on subjects like LBO modeling., and "accountant just" topics like test equilibriums and how to stroll through occasions using debits and credit reports rather than click to read more economic statement modifications.

Some Of Transaction Advisory Services

that show just how both metrics have actually transformed based upon items, networks, and consumers. to evaluate the precision of monitoring's past forecasts., including aging, stock by item, typical degrees, and stipulations. to establish whether they're completely fictional or rather credible. Experts in the TS/ FDD teams may additionally talk to monitoring regarding whatever above, and they'll write a comprehensive report with their Learn More Here searchings for at the end of the procedure., and the basic form looks like this: The entry-level function, where you do a lot of information and financial evaluation (2 years for a promotion from here). The following degree up; similar work, but you obtain the more fascinating little bits (3 years for a promotion).

Particularly, it's difficult to obtain advertised beyond the Manager level because few individuals leave the work at that stage, and you need to begin revealing evidence of your capability to create income to advance. Let's start with the hours and way of living since those are much easier to define:. There are occasional late nights and weekend break job, but absolutely nothing like the agitated nature of investment banking.

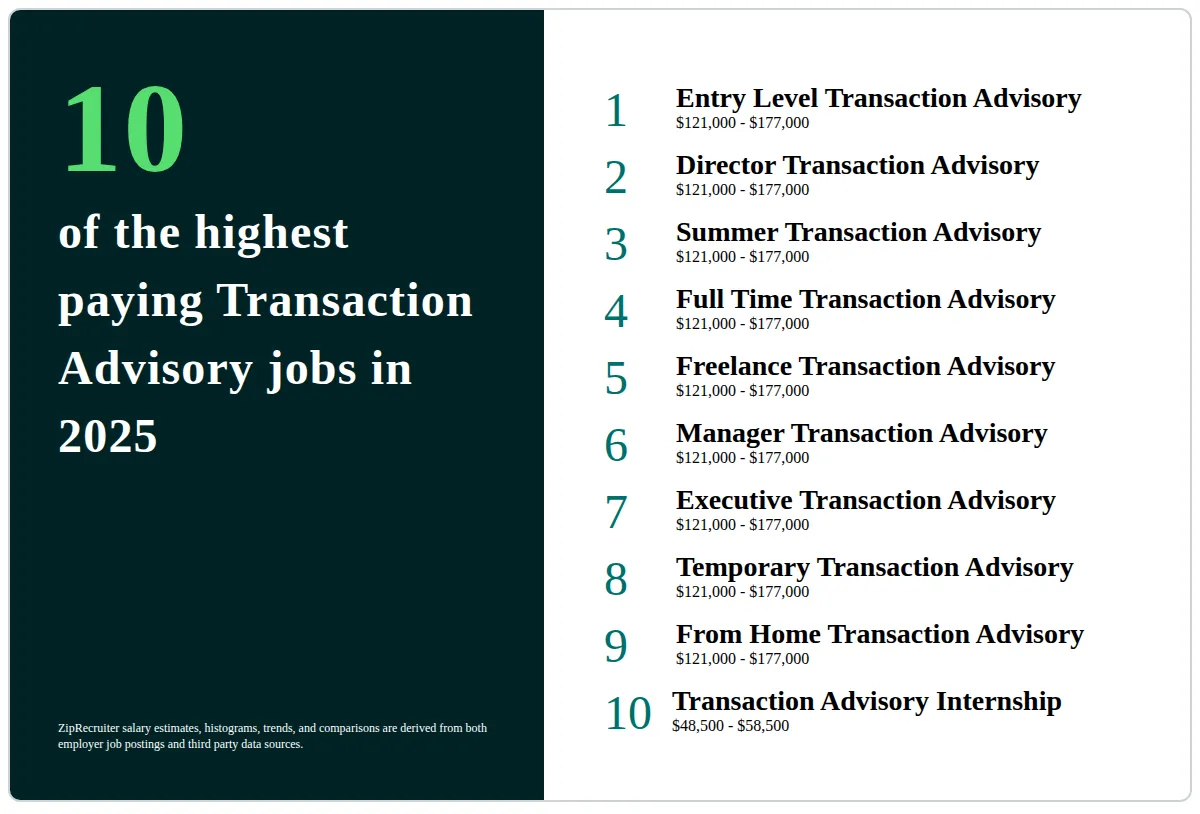

There are cost-of-living modifications, so expect reduced settlement if you're in a less costly area outside major financial (Transaction Advisory Services). For all settings except Companion, the base wage consists of the mass of the overall compensation; the year-end benefit could be a max of 30% of your base pay. Commonly, the most effective way to boost your revenues is to switch over to a different firm and bargain for a greater salary and reward

The smart Trick of Transaction Advisory Services That Nobody is Talking About

You can get into company growth, but investment financial obtains much more hard at this stage since you'll be over-qualified for Expert functions. Company finance is still an option. At this phase, you should simply remain and make a run for a Partner-level function. If you want to leave, possibly transfer to a client and perform their appraisals and due persistance in-house.The primary problem is that since: You usually require to join an additional Huge 4 group, such as audit, and job there for a couple of years and after that relocate into TS, job there for a few years and afterwards move right into IB. And there's still no guarantee of winning this IB function because it depends on your region, clients, and the working with market at the time.

Longer-term, there is also some threat of and since assessing a firm's historical financial details is not exactly brain surgery. Yes, people will certainly always require to be entailed, but with even more innovative innovation, reduced headcounts can possibly a fantastic read sustain client interactions. That stated, the Deal Solutions team beats audit in regards to pay, work, and departure opportunities.

If you liked this write-up, you could be curious about analysis.

Transaction Advisory Services Fundamentals Explained

Create innovative financial frameworks that aid in figuring out the actual market price of a firm. Give advisory work in relation to organization evaluation to aid in bargaining and prices frameworks. Explain the most suitable form of the deal and the type of consideration to utilize (money, stock, make out, and others).

Execute integration planning to establish the process, system, and business modifications that might be called for after the bargain. Set guidelines for integrating departments, innovations, and business procedures.

Examine the potential customer base, industry verticals, and sales cycle. The operational due persistance uses vital insights into the functioning of the firm to be obtained concerning risk assessment and value production.

Report this wiki page